utility for service tax return

Assessees can file their Central Excise and Service Tax Returns using following offline Excel UtilitiesXML Schema by downloading the same from this page. E-Filing of Income Tax Return or Forms and other value added services Intimation Rectification Refund and other Income Tax Processing Related Queries.

Download ST3 Return Utility for Oct to Mar 14 Service Tax Return Filing.

. Omnibus operators subject to nys department of public service supervision. Learn how to pay your business taxes or apply for a business license in Seattle. 2007-2021 Utility Tax Service LLC.

The service tax return is required to be filed by any person liable to pay the service tax. The last date of filing the ST-3 return. Business Taxes Information about business taxes.

Urban transportation and watercraft vessels under 65 feet in length. Service Tax Return ST-3 for the period April14 September14 is now available for e-filing by the assesses in both offline and online version. Download Utility Services Tax Return - Gross Income CT-186-P Department of Taxation and Finance New York form.

E-file Tax In Minutes Upload. Utility Tax Service LLC was established in October 2004 and we are committed to providing our clients with the highest quality service in the property tax industry. 1800 103 0025 or.

Download ER1 Return Excel. Telegraph companies distribution of natural gas and collection of sewerage. Currently we represent over.

Current Utility Tax Forms 2021 Utility Tax Forms. Assessees can file their Central Excise and Service Tax Returns using following offline Excel UtilitiesXML Schema by downloading the. Utility services use tax due for the period multiply line 4 by the tax rate of 14 percent 0014.

It may be a flat tax or it may be based on the residents usage. The last date of filing the ST-3. Service Tax Return ST-3 for the period Oct13 -March14 is now available for e-filing by the assessees in.

Attach Form NYC-98UTX IMPOSITIONBASISRATE OF. Browse By State Alabama AL. Business Taxes and Licenses.

E-Filing of Income Tax Return or Forms and other value added services Intimation Rectification Refund and other Income Tax Processing Related Queries. Omnibus operators subject to nys department of public service supervision. Documents on this page are provided in pdf format.

Utility services use tax due for the period multiply line 4 by the tax rate of 14 percent 0014. File a Damage Claim. Service Tax Return ST-3 for the period April -September 13 is now available in ACES for e-filing by the assesses in both offline and online version.

NYC-98UTX - Claim for. 1800 103 0025 or. Information contained in this website is subject to change without notice.

Enter on this line the credit against the Utility Tax for the new Lower Manhattan relocation and employment assistance program. NYC-95UTX - Claim for REAP Credit Applied to the Utility Tax. Please contact the tax office if you have any questions.

Assessees can file their Central Excise and Service Tax Returns using following offline Excel UtilitiesXML Schema by downloading the.

Due Date To File Service Tax Return 4 13 To 9 13 Is 25 10 2013 Online Offline Facility Available Now Simple Tax India

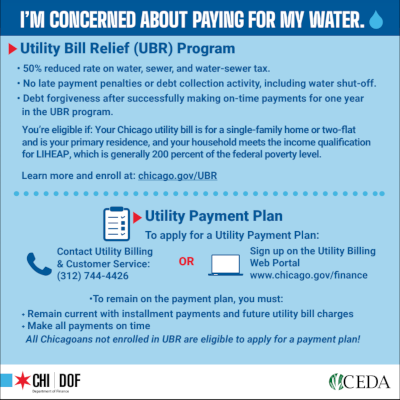

City Of Chicago Utility Billing Customer Service

Irs Mailing Address Where To Mail Irs Payments File

Trident United Way And Sc Thrive Urge People To Use Free Online Tax Filing Service Sponsored Content Post And Courier Charleston Sc

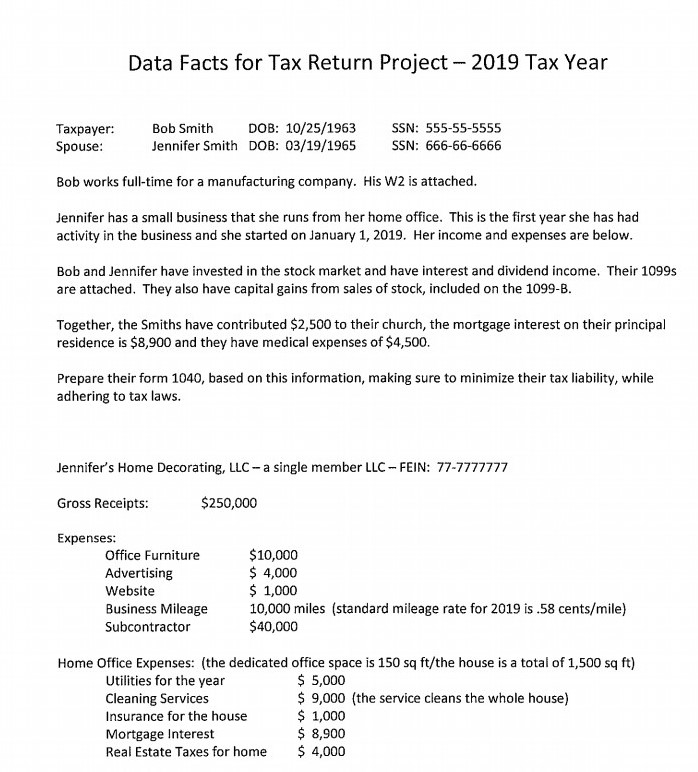

Data Facts For Tax Return Project 2019 Tax Year Chegg Com

Federal Tax Returns 30 Investment Tax Credit Itc Native Solar

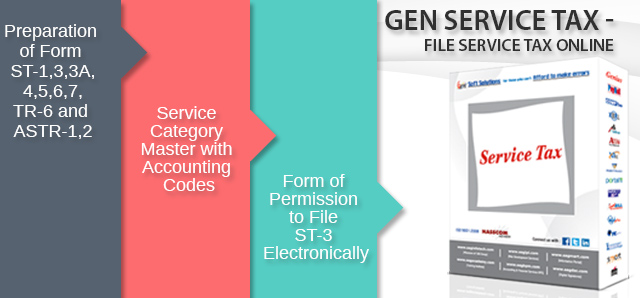

Free Service Tax Return Software Download Gen Service Tax

Solved E Filing The Table Shows The Numbers Of Tax Returns In Millions Made Through E File From 2000 Through 2007 Let F T Represent The Number Of Tax Returns Made Through E File In The Year

Service Tax Return St 3 Excel Utility Oct 2016 Mar 2017

Usa Ohio Lorain Medina Rural Electric Utility Bill Templa In 2022 Bill Template Lorain Templates

Irs Will Start Accepting Tax Returns Feb 12 Later Than Usual Wsj

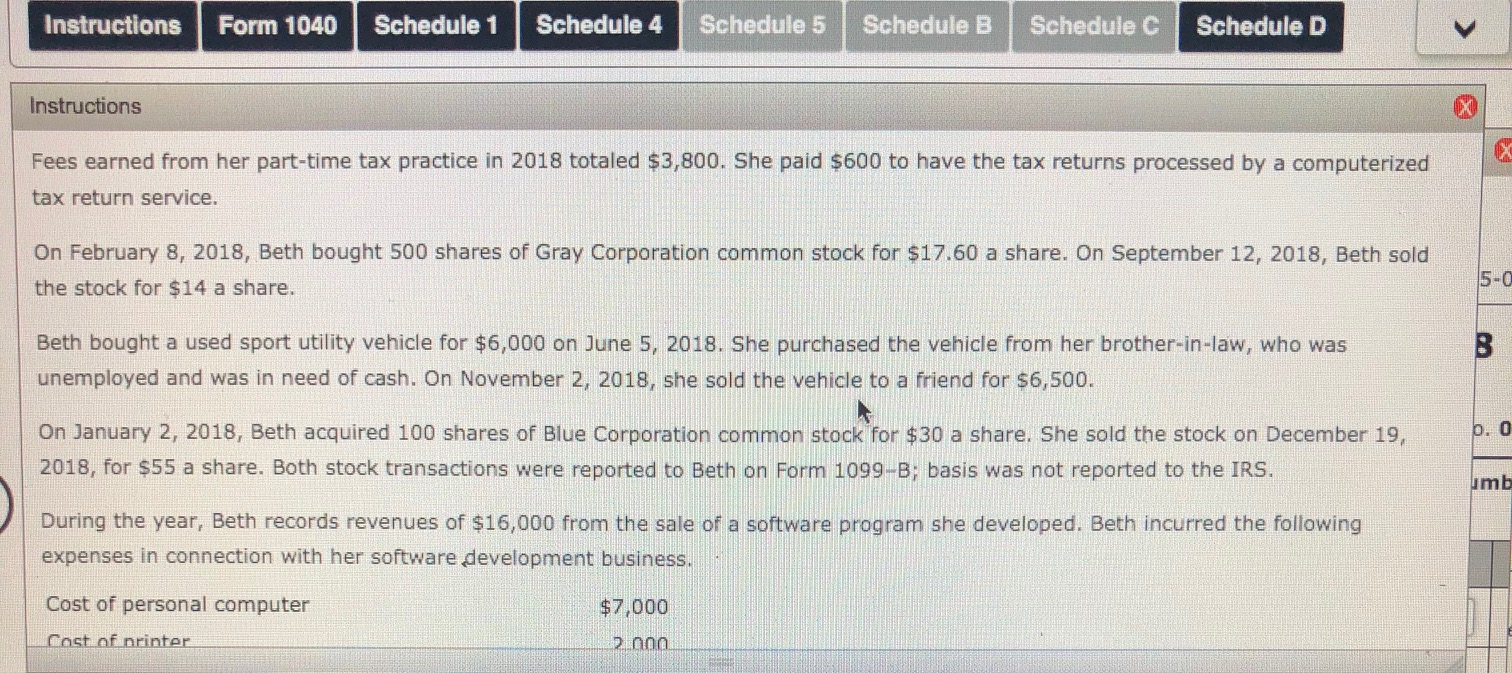

Instructions Form 1040 Schedule 1 Schedule 4 Schedule Chegg Com

E Filing Of Service Tax Return For Apr 14 To Sep 14 Enabled Due Date 25 10 14 Simple Tax India

Service Tax Return Due Date Penalty For Late Filing For Period April 16 To Sep 16 Simple Tax India

Software For Complex Tax Returns Intuit Lacerte

How To Upload Service Tax Return Xml File Step By Step Guide Simple Tax India

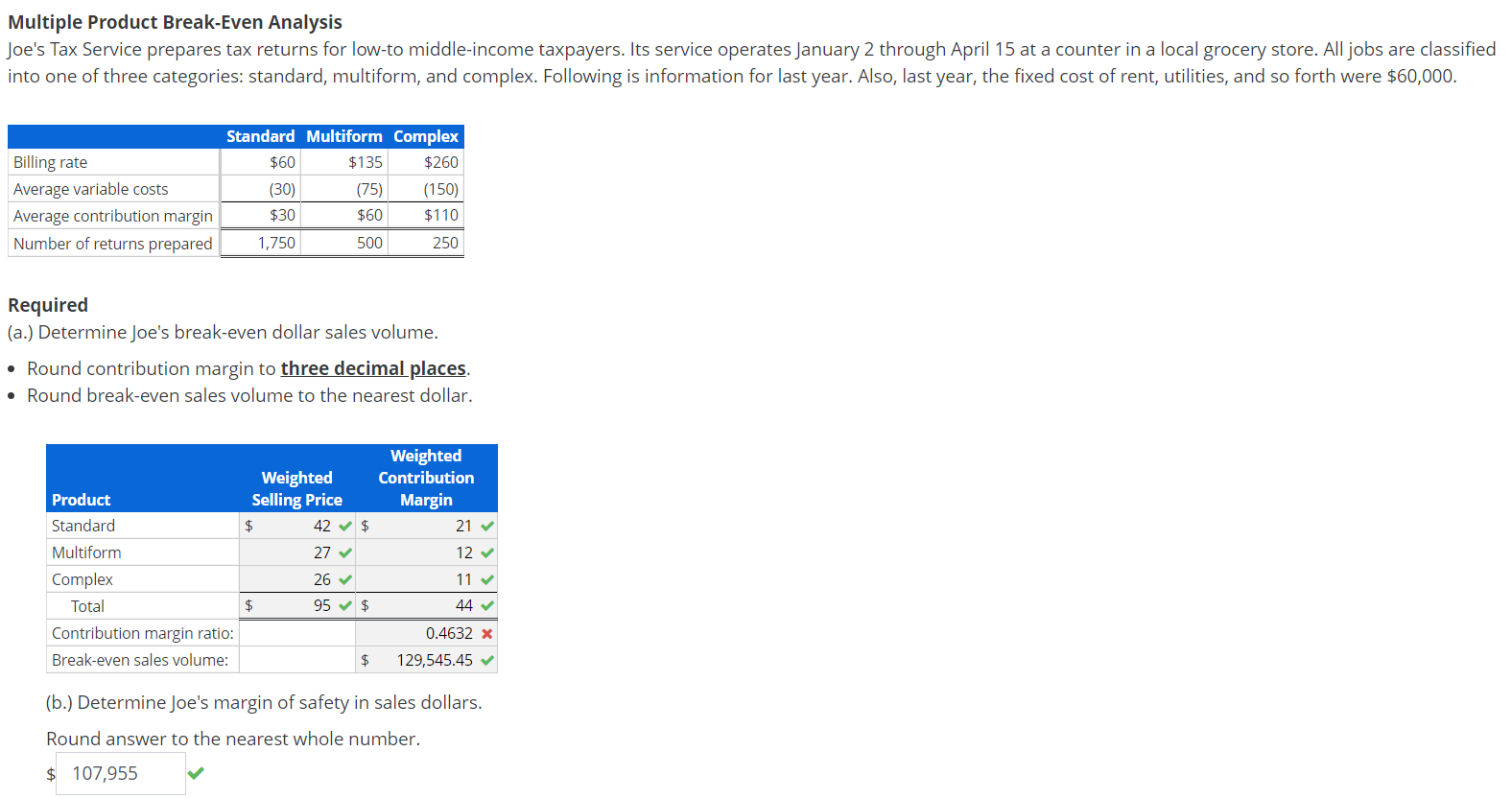

Solved Multiple Product Break Even Analysis Joe S Tax Chegg Com

Do I Need To File A Tax Return Forbes Advisor

U S Citizens Now Able To Pay Taxes Utilities And Mortgages With Bitcoin Roundtable Crypto